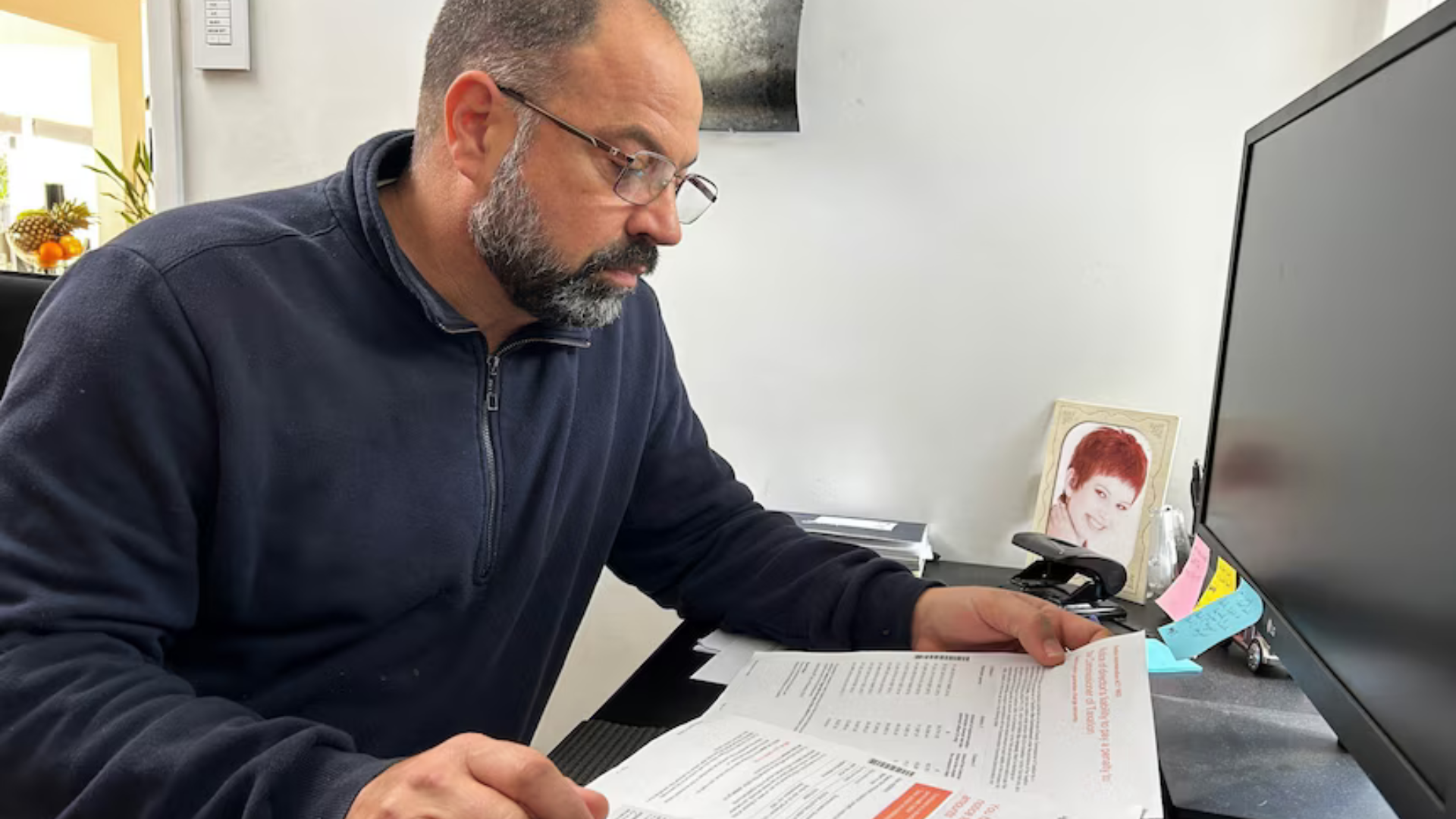

Andrew Christodoulou is determined to fight back after the Australian Taxation Office (ATO) sent him a Director Penalty Notice claiming he owes $437,000 in unpaid superannuation guarantee contributions.

Mr Christodoulou told ABC News he received a Director Penalty Notice from the ATO in November 2023, and was expected to pay back the funds within 21 days.

The tax authority alleges the company that Mr Christodoulou ran for 22 years, which went into voluntary administration in 2016 and closed three years later, owes superannuation to workers it employed at the time.

Some of the alleged debts date back to April 2013 while Mr Christodoulou was a director of the security firm, Kudos Australasia.

Company directors must ensure their company’s tax and super obligations are reported and paid on time. If the company misses payment deadlines, the ATO can recover these amounts from the director personally, even if they are no longer in the role.

“How the hell could I owe $437,000 — it is more than my mortgage,” he told ABC News.

Mr Christodoulou said he believes workers should be paid their superannuation, but argued unpaid super debt should have been handled at the time.

“These debts that they are chasing were listed from 2013 — we’re talking 11 years ago now,” he said.

“If they [the ATO] had come to us in 2014 or 2015… we could have sorted it out. Back then it was absolutely doable. But to come forward all these years later, with a figure that has no justification, no clarification around it, and give you 21 days to figure it out?”

Mr Christodoulou is working to resolve the dispute with the ATO but he said legal fees are piling up and he fears the tax authority could bankrupt him.

Issues with Director Penalty Notices have come into the spotlight in recent months, with the Federal Government instructing the ATO to pursue over $34 billion in debt owed by small businesses and self-employed Australians, much of which was deferred during COVID.

Source: ABC News.