The coronavirus has taken its toll on every country, geopolitically and financially. Yet while some countries’ leaders are making decisive actions to ensure economic stabilisation post-coronavirus, others are not.

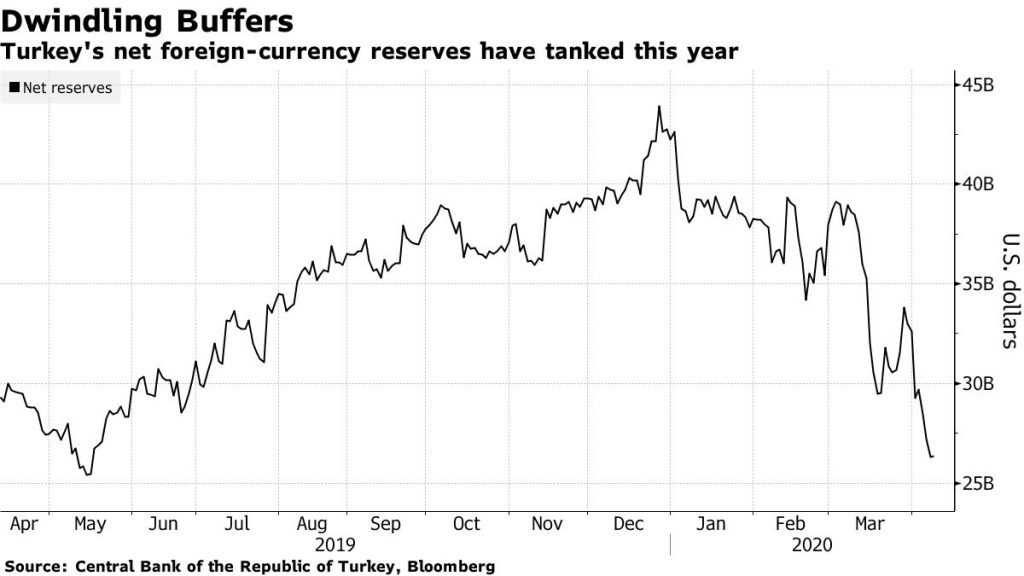

As Turkey runs dangerously low on foreign-currency reserves, its economy may succumb to a recession amid the coronavirus pandemic. While many believe this to be the cause of Erdogan’s drive for ever-lower borrowing costs in recent years, diminishing Turks’ confidence in their own currency, it is certain that Turkish leaders are faced with limited options to help stabilise the Turkish economy.

Bloomberg analyses the economic strategies being presented to the Turkish Government and President Recep Tayyip Erdogan.

The Options Being Presented

A pro-government newspaper reached out to the possibility of borrowing from the International Monetary Fund, helping give legitimacy to what officials have long publicly regarded as a non-starter. When asked Thursday how the IMF might assist Turkey, the fund’s chief said the institution has “a very constructive engagement” with it.

“We have been consulting all our members in this crisis on what are the policy actions that can help steer the economies through this very difficult time. In this virtual spring meeting that’s coming just next week, we will continue this constructive engagement with the membership, including with Turkey,” the fund’s managing director, Kristalina Georgieva, said Thursday in a Bloomberg Television interview.

Other economists have mentioned the option of printing money to help shoulder the burden of the stimulus needed to prop up growth. Bloomberg mentions that this path that appears to be more tenable now that the central bank is soaking up sovereign bonds from the secondary market.

Per Hammarlund, chief emerging-markets strategist at SEB AB in Stockholm, presents a third option for Turkey. The strategist suggests that Turkey could impose capital controls, with the government being more likely to seek bilateral support from the U.S., China or the European Union to restore confidence.

“Capital controls are a double-edged sword as they also keep sorely needed capital out of the country,” Hammarlund said. Turkish officials have in the past given assurances that capital controls weren’t an option even when they struggled to stabilise the currency.

Action Must Be Taken Now

If Erdogan persists with doubling down on mistakes made in the past, he will undoubtedly bring further economic ruin to Turkey, with financial consequences that Turkish citizens will bear far beyond the pandemic’s end.

The last time the IMF bailed out Turkey in 2001, the financial crisis at the time wiped out a whole generation of Turkey’s political leaders.

“Any IMF package would likely put an end to the president’s growth-at-all-costs-approach to running the economy”, Bloomberg reports.

“Yet time could be running out, with hundreds of thousands of businesses already shut down because of the outbreak and the fate of the country’s $34.5 billion tourism industry at stake.”

Read More: Letter from the Editor: #KeepItGreek while we stay at home

Read More: Turkey in review: The lira crisis, censorship controversy & COVID-19 trajectory

Whichever action Turkey pursues, Erdogan must choose an option swiftly and decisively in order to achieve economic stability for the next 10 years.

“Ankara needs to figure out a way of bailing out the economy without causing a balance-of-payments crisis,” Global Source Partners economists including Murat Ucer in Istanbul said in a report. “And because this is so difficult to do on its own, the only practical solution, normatively speaking, is an IMF program — no matter how unrealistic the politics of it may sound.”

A full analysis on Turkey’s economic options can be observed in the Bloomberg report: HERE