Every year the Federal Budget comprises thousands of pages of facts and figures covering spending on everything from tax cuts, health, education, welfare and more.

We’ve broken the most important information down into the things that really affect everyday Australians.

Find out what the 2021-22 Federal Budget means for you.

Economy

- Economic growth will be 1.25 per cent in 2020-21 and reach a strong 4.25 per cent in 2021-22 before falling to 2.5 per cent the following year.

- Unemployment has defied doomsday predictions of 8 per cent or more and is predicted to be 5.5 per cent this year. Next year it will fall to 5 per cent and then 4.75 per cent in 2022-23.

- International borders will begin to re-open in 2022 but inbound and outbound travellers will remain at very low levels until the middle of 2022 at the earliest.

- The 2020-21 deficit has been revised down by $52.7 billion from $213.7 billion to $161 billion

Women and Families

- An additional $1.1 billion will be spent on women’s safety measures, including $261.4 million over two years in a new deal with the states to boost frontline family, domestic and sexual violence services.

- There’s $351.6 million in funding for new health measures including more cash for drugs to fight breast cancer, lung cancer and osteoporosis and for women’s health initiatives that cover maternal, sexual and reproductive health. There’s also money for endometriosis research and genetic testing for pregnant women.

- $1.7 billion over five years in extra money to cut the cost of childcare for families with two or more kids. Measures will boost the childcare rebate and remove the annual subsidy cap of $10,560 for high-income earners

Aged Care

There is $17.7 billion over five years responding to the Aged Care Royal Commission report on abuse and neglect in the system, including:

- $6.5 billion for an extra 80,000 home care packages over two years, to help more people live in their homes for longer.

- $3.2 billion to cover a $10 per person, per day increase in payment to aged care providers.

- $3.9 billion to increase the number of “care minutes” each aged care resident receives per day to 200 minutes.

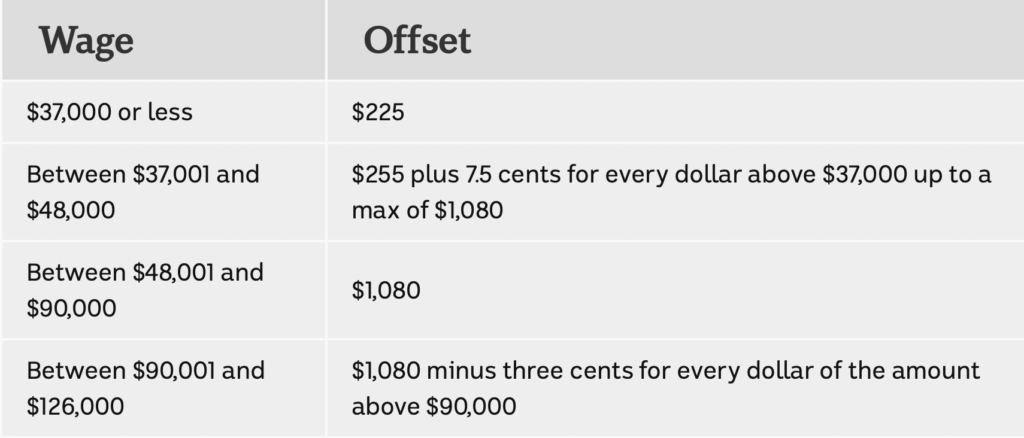

Income Tax

The so-called “Low and Middle Income Tax Offset” will remain in place for another year.

The tax rebate, which workers receive after completing their tax returns, is worth different amounts to different income groups. It was supposed to finish on June 30 but it will be extended by another 12 months.

This is how much you can expect to land back in your bank account if you’re in any of these wage brackets:

Mental Health

In his speech, the Treasurer shone a spotlight on the more than 65,000 Australians who attempt to take their own lives each year. Suicide is the leading cause of death among those aged 18 to 44, and so the government has committed $2.3 billion to mental health care and suicide prevention.

The money will be spent on:

- More Headspace centres to support more young Australians

- Expanding the model to those aged over 25, with a new Head to Health national network of 40 centres

- Extra funding for treatment of eating disorders

- Greater access to psychiatrists, psychologists and GPs through Medicare

- Universal access to care for people discharged from hospital after attempting to take their own life

- Establishing a new National Suicide Prevention Office

- Setting up a Royal Commission into Defence and Veterans Suicide.

Business Owners

As well as the support announced for particular industries like small brewers, video gaming and medical and biotech start-ups, the budget also has a few perks for other businesses.

Last year’s business write-off perks are being extended by another 12 months.

That means businesses with a turnover of up to $5 billion will be able to write off the full value of any eligible asset like a work vehicle or equipment they bought between last budget and June 30, 2023.

The extension also mean any losses incurred up to June 2023 can be offset against prior profits made going back to the 2018-19 financial year.

Superannuation

Older Australians will be able to contribute earnings or savings directly into their tax-friendly superannuation funds with the repeal of the “work test”.

Among other changes to super rules, the minimum age for those eligible for the scheme encouraging older people to downsize family homes will be reduced from 65 to 60, first home buyers will be able to access $50,000 of contributions from their super funds, up from $30,000, and people earning less than $450 a month will receive super payments thanks to the removal of the minimum income threshold.

*With information from: ABC, The Daily Telegraph, Sydney Morning Herald, Guardian