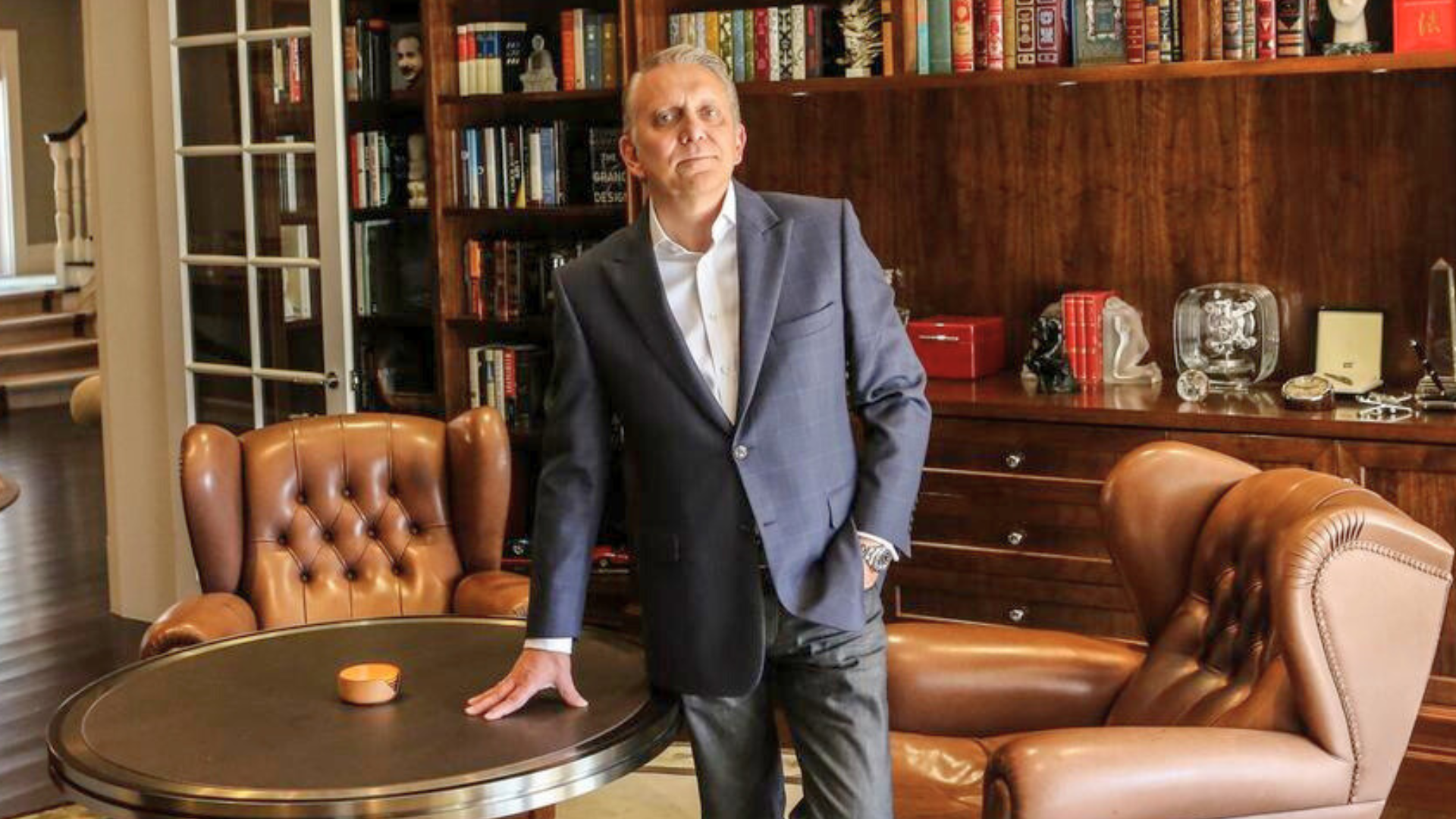

Billionaire Dennis Bastas is aiming to make MCoBeauty one of the top five beauty brands in the US, particularly at retail giant Target, following a landmark $1.6 billion investment from global merchant bank BDT & MSD Partners.

The capital injection gives the firm a minority stake in DBG Health, valuing the business at $7 billion. It marks a major step in Bastas’ strategy to expand MCoBeauty’s footprint from Australian supermarkets to global retailers.

Currently stocked in 1,200 Target and 1,450 Kroger stores in the US, the brand has also recently launched in the UK and parts of Europe.

“We’re really just getting started in the US and that target of being in the top five in America’s largest cosmetics retailer, no other Australian brand has achieved that,” Bastas told The Australian.

“It is an ambitious goal, but one we think is achievable. Target believes in our brand.”

Reaching that goal would require $US300 million (about $463 million) in annual sales.

Bastas plans to use an additional $1 billion from BDT & MSD for further acquisitions, targeting beauty brands in Europe or North America that align with his mass-market philosophy: “We are not about creating niche brands; we are about mass market brands, where quality and affordability will be our key success factors.”

The Melbourne-based pharmaceutical and beauty entrepreneur has grown DBG into a business generating over $2 billion in annual revenue, with brands such as Arrotex, Nude by Nature, and myDNA under its umbrella.

The recent deal effectively doubles DBG’s valuation, positioning it among Australia’s most valuable private companies, and significantly boosts Bastas’ estimated $3 billion fortune.

He remains in control with a 75% stake in DBG and has ruled out local private equity due to shorter investment horizons, opting instead for global partners with greater scale.

The transaction also includes a $2.2 billion debt facility, partly from Goldman Sachs and KKR, to refinance existing debt and fund future deals.

Bastas said the BDT & MSD partnership gives him “plenty of time to pursue over the next five years the goals we want,” with a public listing or major transaction likely to follow.

Source: The Australian.