The tax office has frozen more than $80 million in assets linked to Gold Coast developer, Jim Raptis, and associated companies following the largest offshore data leak in global history – the Pandora Papers.

According to The Australian Financial Review (AFR), the Australian Taxation Office has alleged that Mr Raptis, members of his immediate family and associated entities, were involved in “tax avoidance arrangements.”

Mr Raptis’ $20 million canal-front home, a Lexus 2018 LS500H and shares in ASX-listed entities, including Telstra and the Raptis Group, are among the frozen assets.

The 75-year-old told the AFR on Wednesday: “We intend to work co-operatively with the ATO (and if necessary, lodge objections) to resolve these historical matters. Although we are disappointed with aspects of the orders, we note that business as usual is part of the orders, and all our current projects are progressing as planned.”

READ MORE: Pandora Papers: Law firm founded by Cypriot President named in offshore data leak.

The old-school developer:

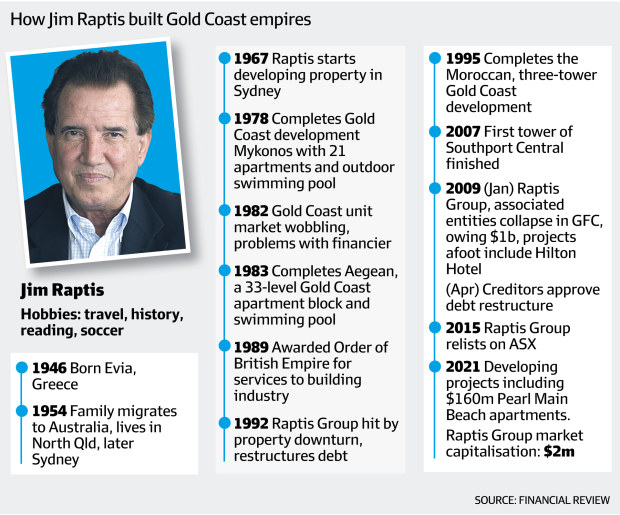

An old-school developer of the Gold Coast, Mr Raptis portrays himself as a visionary of massive apartment complexes on the Glitter Strip such as the Hilton Hotel in Surfers Paradise.

In his director profile for his ASX-listed entity Raptis Group, Mr Raptis pointed out he has an Order of the British Empire and is the Greek Consul for Queensland.

But he has also had three brushes with financial disaster, including in 2009 when his Raptis Group and associated entities fell into administration in the global financial crisis owing almost $1 billion.

During this period, efforts were successfully made to resuscitate the companies via a debt restructuring deal called a deed of company arrangement.

The Samoan connection and the Pandora Papers:

Mr Raptis is the first Greek Australian to be connected to the Pandora Papers leak so far.

The AFR revealed that Mr Raptis has been a long-term beneficiary of a Samoan superannuation fund while a client of tax scheme promoter Vanda Gould. Mr Raptis’ entity was called the Queensland Builders Super Fund. He and his wife Helen, also a director of Raptis Group, were named as beneficiaries of the fund in documents.

The Pandora Papers claimed Mr Raptis’ Samoan trust had interests in a UK company called Sevinhand.

The documents also indicated Mr Raptis was unwittingly entangled in a campaign to shunt money into a war chest designed to keep other offshore funds confidential from UK authorities.

In response to questions about this fund last month, Mr Raptis said: “I have always conducted my financial affairs appropriately and legally” and his investment in an offshore fund was legally done for diversification purposes.

Then on Friday, the ATO took out a surprise action against Mr Raptis, Sevinhand and another private Australian company called Northernson Pty Ltd, seeking to freeze assets.

Mr Raptis was alleged to owe $23.8 million himself following amended tax assessments and penalties for the years 2014 to 2019, the AFR reports.

“As a result of a review-audit the [ATO] has concluded that there are significant amounts of undisclosed income and evasion by Mr Raptis,” the judgment said.

The freezing order also incorporated money in bank accounts in Mr Raptis’ name with ANZ and Suncorp, which were both lenders to Raptis entities that collapsed in the global financial crisis.

Mr Raptis was still allowed $10,000 in weekly living expenses, legal expenses and to deal with ordinary business costs.

Source: The Australian Financial Review.