By Thodoris Roussos

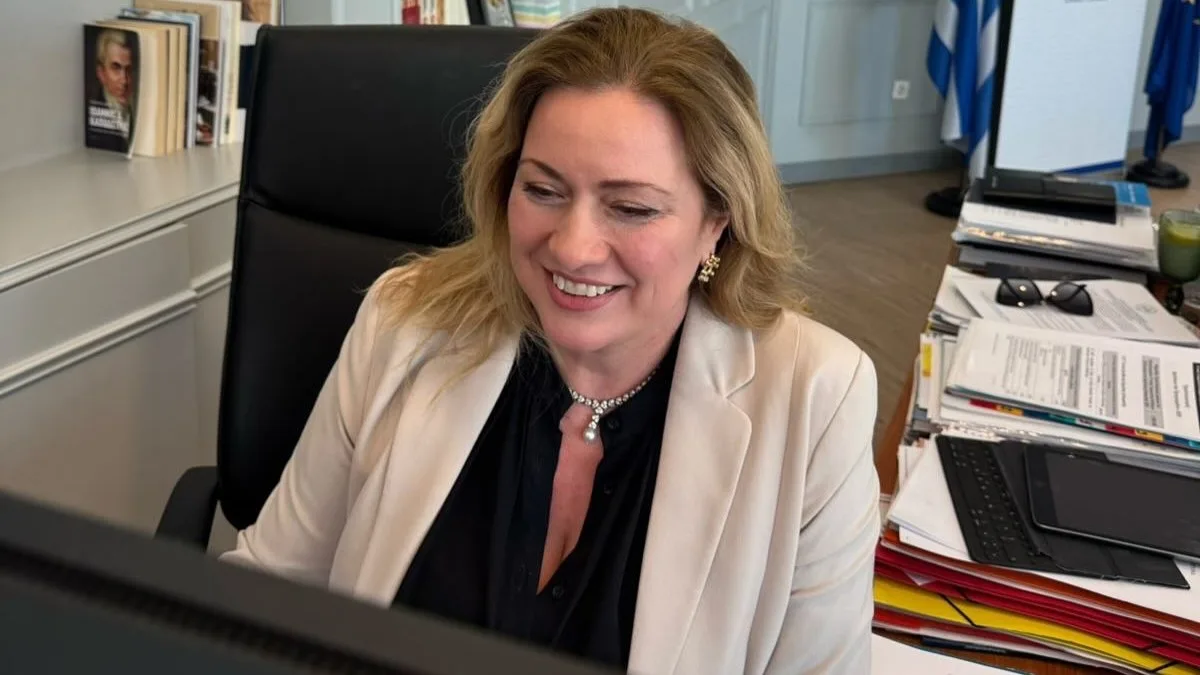

With impressive participation and substantial content, the first online informational event (TaxWebinar), dedicated exclusively to Greeks abroad and tax residents of other countries, was held on Wednesday, July 9.

More than 850 expatriates, from every corner of the globe, logged on to follow the informational initiative co-organised by the General Secretariat for Greeks Abroad and Public Diplomacy of the Ministry of Foreign Affairs and the Independent Authority for Public Revenue (AADE).

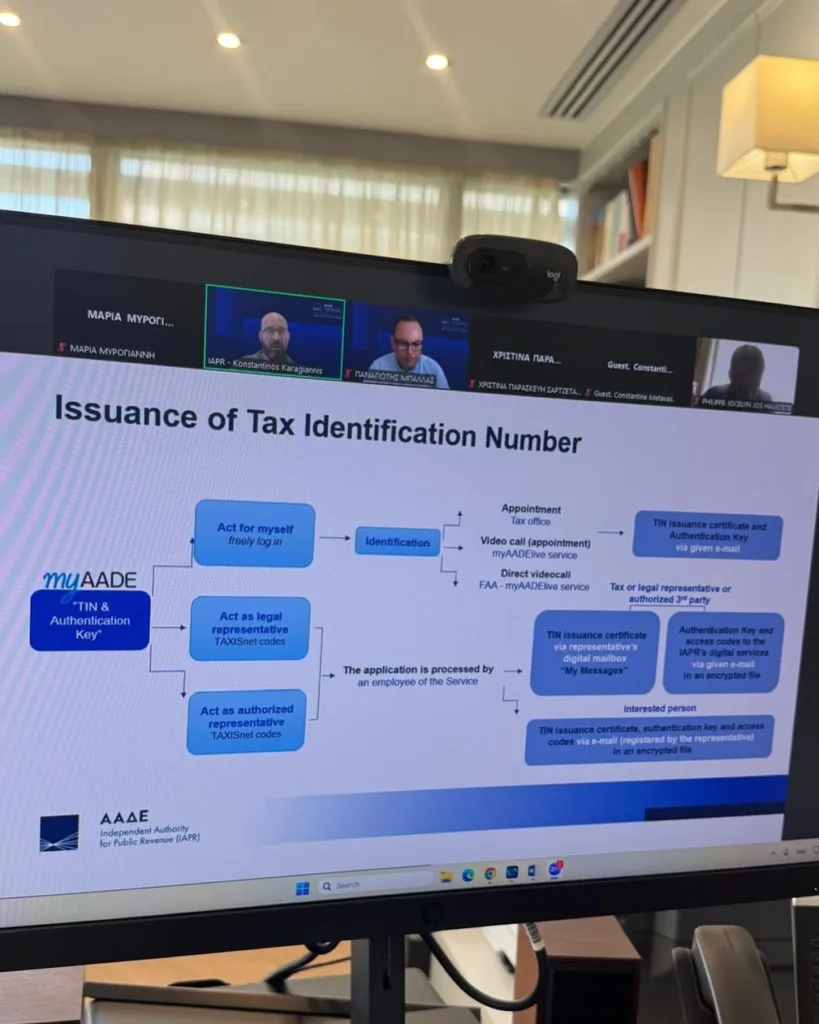

During the webinar, current tax issues concerning Greeks abroad were presented, such as:

- The process of registering in the Greek tax registry and transferring tax residency

- The basic obligations of tax residents abroad

- The available options for alternative taxation and tax incentives for investors and individuals

- The commencement of professional or business activity in Greece

- The customs facilitations for relocating one’s residence to the country

- The digital applications and services of the AADE, which offer safe and continuous access from abroad

The event was opened, via online address, by Secretary General Maira Myrogianni, AADE Governor Giorgos Pitsilis, Director General of Taxation Giorgos Fakos, and Vivian Sartzetaki, Head of Department A’ of the Directorate of Service. The seminar was moderated by Panagiotis Ballas, Director of the Tax and Customs Academy.

Ms Myrogianni pointed out that this particular initiative forms part of a broader strategy of dialogue and support for the diaspora, responding to real requests from expatriate communities.

As she stressed, the goal is to provide meaningful facilitation to Greeks abroad on tax, property and administrative matters, with respect to the particularities of each case.

At the same time, she announced that more targeted informational actions will follow.

“This initiative is the result of ongoing dialogue with Greek communities around the world, it responds to relevant requests from expatriates, and its aim is to facilitate Greeks abroad in their dealings with Greek authorities and services on issues of taxation, finance, property and bureaucratic procedures,” she said, among other things.

From his side, the Governor of AADE, Mr Pitsilis, highlighted the importance of a two-way relationship of trust with Greeks of the diaspora.

As he characteristically stated: “This webinar is tangible proof that we are consistently by your side, with the Greeks of the diaspora and all those who live and are taxed abroad. With modern, user-friendly digital services and immediate information through our website, we strive to serve you easily and effectively—wherever you may be. Your participation and interest give us strength to continue even more decisively, building a relationship of trust that transcends borders and distances.”

More information, useful tools, and answers to frequently asked questions are available on the official AADE website, in the “Expatriates & Residents Abroad” section at www.aade.gr, also available in English.

Special mention must be made of Konstantinos Karagiannis and Ioanna Tsinti, who in turn made sure to answer as many questions as possible from participants regarding their tax obligations as Greeks abroad, as well as how they can settle them.

Due to the enormous participation, there was no time for a Q&A session at the end, but the organisers of the session and the representatives of AADE kindly requested that those participants with questions contact them directly so that they may guide them on anything they need.

Cities such as Sydney, Melbourne, Buenos Aires, Berlin, Tbilisi, California, Chicago, Texas, Brooklyn, Atlanta, Doha, Vienna, Alicante, and countries such as Peru, South Korea, South Africa, Canada, France, Norway were some of those who had representatives in this session.