Melbourne small business owner George Papageorgiou has opened up about how he fell victim to an online lender as he struggled to pay debts he owed to the Australian Taxation Office (ATO) and suppliers.

Mr Papageorgiou, who fixes food trucks and other commercial trucks for a living, told ABC News he found a lender on the internet and took on a loan for $500,000.

“I thought we were getting the full amount and you could refinance it after a year. But it didn’t work out that way,” he said.

The lender took the interest up-front and gave Mr Papageorgiou $380,000. He’d already signed the contract and put up the family home as collateral, with his wife as guarantor.

“We’ll probably have to sell the house,” he told ABC News.

“My wife’s not very happy, but she’s very supportive. So once the house goes, the kids will be sad, because it’s the family home.”

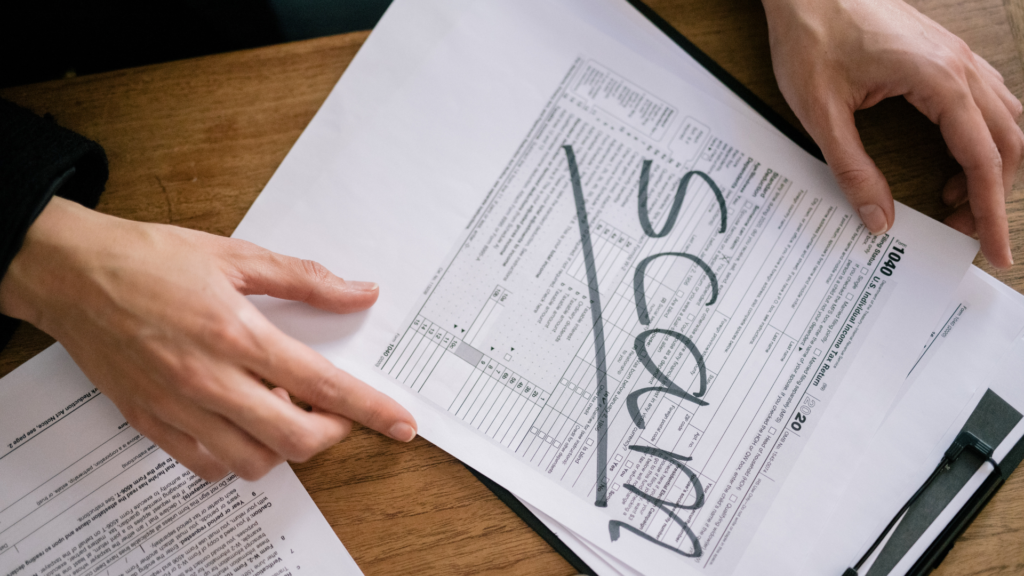

Ms Papageorgiou is among a growing number of small business owners who face hardship after falling prey to online lenders offering them quick cash. They sign up to contracts they don’t understand and land them with hundreds of thousands of dollars of more debt.

A spokeswoman for ASIC told ABC News that high-cost credit and predatory lending practices to small businesses were one of ASIC’s enforcement priorities for 2024 and that alleged misconduct could be reported to the regulator.

Source: ABC News.