The Australian has released its annual list of Australia’s 250 wealthiest individuals and among the names are 12 Australians of Greek heritage. One of the Greeks has made his debut on the list.

Who are they and how have they become so successful in life? The Greek Herald finds out.

59 – Nick Politis, $2.2 billion:

Nick Politis is the Owner of WFM Motors and Director of AP Eagers. He is the most successful car salesman in Australia, with an empire that includes dozens of his own car dealers in Sydney, Melbourne and Queensland. He is also the Chairman of the NRL club, Sydney Roosters.

86/87 – Terry and Arthur Tzaneros, $1.56 billion:

Father and son duo, Terry and Arthur Tzaneros, own ACFS Port Logistics, the largest privately owned container logistics operator in Australia, and freight logistics firm, AGS World Transport. Terry and Arthur started ACFS Port Logistics in 2005 and it now employs more than 1100 people across Australia.

102 – Nick Andrianakos and Family, $1.3 billion:

Nick Andrianakos is the Founder of Milemaker Petroleum and Nikos Property. The Milemaker chain comprised 54 sites when it was sold to Caltex in a $94 million deal in late 2016. By then, Andrianakos was already investing in commercial property and crucially he also kept the freehold sites of the petrol stations.

110 – Dennis Bastas, $1.23 billion:

Dennis Bastas is the Founder, Chairman and CEO of Arrotex Pharmaceuticals. Arrotex makes about one-third of the drugs dispensed under the Pharmaceutical Benefits Scheme and turns over $1.1 billion annually. Bastas is also chairman and controls 50 per cent of Juno Pharmaceuticals, which supplies hospitals with drugs used in oncology and surgery, and owns a stake in genomics company My DNA.

114 – Theo Karedis and Family, $1.16 billion:

Theo Karedis is the co-founder of Theo’s Liquor and Arkadia Property Group. The Karedis family fortune stems from the Theo’s chain of bottle shops sold to Coles in 2002. Arkadia owns 25 mostly retail properties around Australia.

120 – Nicholas Paspaley and Family, $1.12 billion:

Nicholas Paspaley is the Executive Chairman of the Paspaley Group of Companies. The Group has a pearl retail business, an aviation and marine services division, pastoral and tourism holdings, and a property portfolio. The family last year opened the luxury Wall Street Hotel in New York and also owns luxury apartments it rents out in Aspen.

162 – Spiros Alysandratos, $850 million:

Spiros Alysandratos is the founder of one of Australia’s biggest backroom travel companies, Consolidated Travel. His business sells ticketing technology and services to airlines and travel agents, and also travel insurance products.

167 – Con Makris and Family, $813 million:

Con Makris is the Chairman of Makris Group and although he has been gradually selling down his property portfolio in recent years, he retains substantial assets on the Gold Coast and shopping centres in Adelaide and Melbourne.

172 – Harry Stamoulis and Family, $767 million:

The Stamoulis wealth is found in Melbourne commercial property. Harry oversees assets that include office buildings and distribution centres. The family also supports Melbourne’s Hellenic Museum.

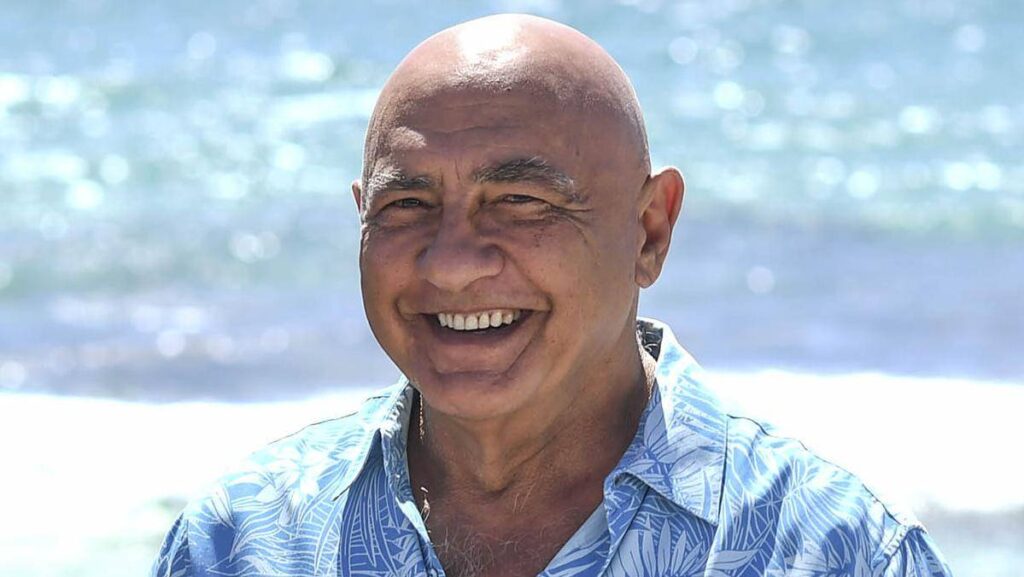

189 – Kerry Haramis, $683 million:

Kerry Harmanis is one of Western Australia’s most successful mining executives and investors, making more than $400 million from the sale of his former nickel play Jubilee Mines to Xstrata in a $3.1 billion deal in 2007. He now has shareholdings in several listed mining exploration companies. He has also set up Mindful Meditation Australia to teach teachers to educate children about meditation and mindfulness.

226 – Ilias Pavlopoulos, $570 million:

Ilias Pavlopoulos and Andrew Chepul head one of Australia’s biggest non-bank lenders, ColCap, which they founded in 2006. It has a loan portfolio of more than $12 billion, and more than 260 staff in Australia, the UK and the Philippines. Its brands include Origin Mortgage Management Services, Homestar Finance and Granite Home Loans. ColCap makes annual net profits of about $60 million according to documents lodged with the corporate regulator.

Source: The Australian.