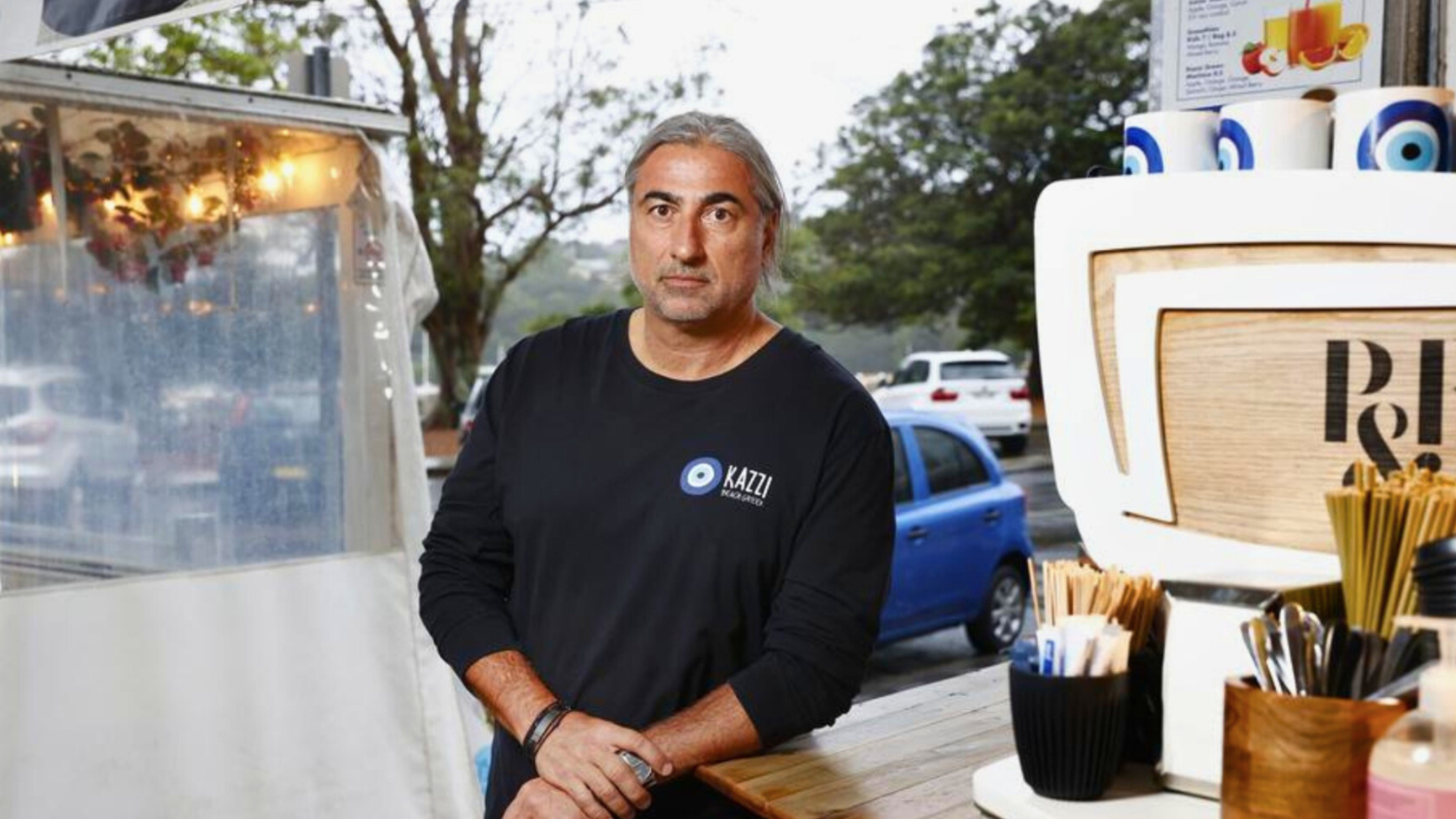

Sydney restaurateur Peter Papas has raised concerns over the Reserve Bank of Australia’s proposal to ban credit and debit card surcharges, warning it could leave small business owners footing the bill if banks fail to lower transaction fees.

“The danger for the restaurateur is that we remain the proverbial ‘piggy in the middle’ and we actually pay the cost,” said Papas, who owns Kazzi Beach Greek in Balmoral and Manly.

The RBA released a consultation paper on Tuesday proposing a total ban on surcharges, estimating it would save consumers $1.2 billion.

The plan would require banks to lower interchange fees, costs currently paid by merchants when customers use cards.

However, Papas is sceptical the banks will reduce fees enough to offset lost surcharge revenue and says small businesses would be hit hardest.

He also dismissed the RBA’s suggestion that increased transparency from Visa and Mastercard would help businesses find better deals, calling it “utterly useless.”

“That information is readily available in the marketplace as it stands,” he said.

“We can’t easily switch. We really are users of all payment platforms … We have to do that because of the way the market is and to remain viable.”

Papas joins other hospitality leaders in opposing the proposal, warning that without the ability to pass on costs, businesses may be forced to increase menu prices to stay afloat.

Source: A Financial Review.