Members of the Cyprus Community of New South Wales are set to vote on the future of the Cyprus Club at Stanmore in Sydney during an Extraordinary General Meeting on Sunday, October 22 at 3pm.

The club site at 58 – 76 Stanmore Road, Stanmore, was granted conditional rezoning by the NSW Department of Planning and Environment (DPE) in May this year. The Club is also a “Planning NSW State Significant Development Site” as it has been appraised at over $70 million.

The property remains the subject of fierce debate amongst members of the Community.

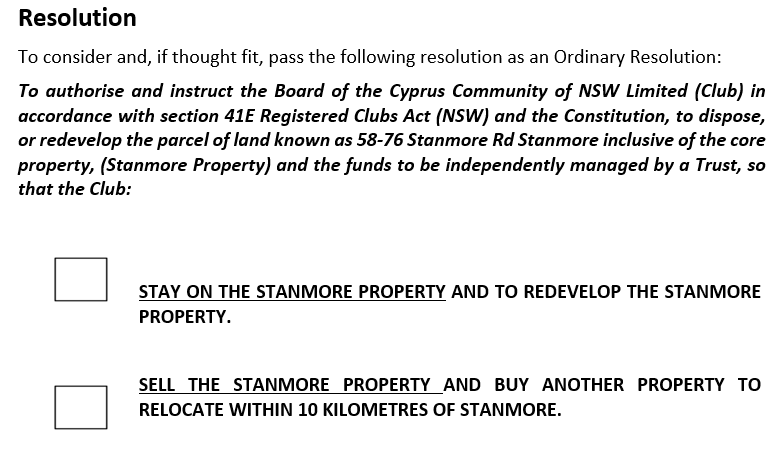

At the upcoming EGM, members will be asked to vote by way of a paper ballot on whether to stay or sell the Stanmore property. The specific resolution on the ballot paper will be:

According to the explanatory notes provided to members ahead of the EGM, there are many parts to each option.

OPTION 1 – Stay at the Stanmore property:

A stay vote means the Club stays on the Stanmore property and the Board is authorised to redevelop the property to preserve the Club’s identity. The Board is also authorised to contribute to the design and facilities of the entire redevelopment. It does not mean the Club will necessarily remain in the same building or that the Club will have a new building with the specifications of the current building. Any redevelopment must be consistent with the Club’s character and mission to ensure the precinct has a “Greek-Cypriot” character.

The Club may choose to renovate or demolish and build new premises. Either way, the Club will prepare suitable plans to build a new building or refurbish the existing building. The stay option would require designs and plans to be displayed for members to review and comment.

A subsequent Development Application would be required and may be completed in collaboration with the incoming buyer/joint venture party. A joint venture of the entire site will only be considered if it does not expose the property and/or the Club to any undue risk.

This resolution does not mean the Club will be the developer.

A Joint Venture party would be required to pay out all the debt and provide working capital for the Club. The Club may offer its property without the need to mortgage the land. The developer/investor will put in their assets as security to fund, design and build the project.

The Club will continue to trade at the same location for at least two years to complete Development Application process and will be relocated whilst the development takes place, which will be funded by the joint venture party.

As the 9,128m2 site is a ‘Planning NSW State Significant Development Site‘ after it was recently appraised at over $70 million, any Development Application of this value will bypass Inner West Council and be assessed at State Government Level by Planning NSW.

A part of the resolution is a commitment to invest the proceeds from the redevelopment, less repayment of debt and working capital, in a Trust Bank Account governed by independent trustees. The Trust shall have a strict mandate on how they are to invest the funds, and preserve the principal (the money received from the proceeds of redeveloping the Stanmore property).

OPTION 2 – Sell the Stanmore property:

A majority sell vote means the Board is authorised to place the entire Stanmore property on the open market with a view to maximising the returns to the Community.

This option means the Club’s debts are paid in full, whilst the Club remains open for all members, friends and guests. The Club sale terms will include a minimum two-year lease back at a nominal rent, whilst new premises are located within a 10 km radius of Stanmore.

The property will be sold as a whole via public sale. Being a State Significant Property, the site hopes to attract the country’s top tier developers. In addition, the state government has recently announced an additional 30% increase in allowable floor space and height which may increase the final sale price significantly.

Sale proceeds, less repayment of debt, shall be held in a Trust Bank Account governed by independent trustees.

With this option the Club may receive in excess of $70 million dollars, less debts, the Club will then be in a position to re-locate retaining its Greek Cypriot character with new modern facilities which may include sporting facilities such as synthetic sports field, Function Hall/Theatre, Restaurant/Gym/Greek Dancing School facilities.

There may be an opportunity to retain a “satellite” club within the Stanmore property which may consist of Cypriot Taverna-Restaurant, smaller Function Hall with meeting rooms and other facilities. The sale option is said to free the Club from the physical limits of the Stanmore property to look at a much larger site.

Management of funds via The Cyprus Trust (NSW):

The Board has proposed to establish an independent trust to hold and manage the funds. The establishment of the Trust forms part of both STAY and SELL options.

To ensure the funds are preserved, less the payment of the debt and working capital, it is the Board’s view that no Board shall have access to the principal without accountability from an independent third party.

Titled “Cyprus Trust” the Board shall seek advice from suitable qualified third parties to appoint on a 3-year term up to up five trustees who will manage the funds.

All members will be entitled to nominate suitable persons for the role, with at least three members to be independent of the Club and two to be full members of the Club.

The Trust shall be audited as a related party to the Club, the bank statement and the Audit report to be included in the members newsletter and annual report.

The Trust will be primarily concerned to preserve the funds, and only make available revenue generated by the Trust.

The Trust may invest in high quality real estate and government-backed securities.

The Trust shall form a valuable source of funds for the club’s charitable mission, its community, education, culture, and teaching endeavours.

‘Stay and do nothing’ is not a viable option:

According to the explanatory notes, the option to stay at the Stanmore property and do nothing (i.e. no redevelopment or sale) is not offered on the ballot as it is not a viable solution.

An external auditor report suggests Club revenue has been extremely poor for many years, with debts of well over $8 million accumulated. Most of the debt is in the form of loans to fund real estate purchased by the Club over the years.

Adelaide Bendigo Bank have advised the Club their loan term will end soon and they will not be renewing the loan. The interest bill for both Cyprus Capital and Adelaide Bendigo loans exceed $9,000 per week.

On August 30 this year, the Club also received a Fire Compliance Order EPA-2020-0163 from the Inner West Council, and if these works are not completed, significant penalties apply.

Although the Club has remained financially solvent due to the many members who invested in Cyprus Capital Ltd to support the Club, the external auditor’s report indicated that a ‘stay and do nothing’ option is still not viable as the debt needs to be repaid at some point.

Do you want to find out more about these options ahead of the EGM on Sunday, October 22 at the Cyprus Club at 3pm?

Copies of the proposed resolution with background information and Explanatory Notes will be on display at the foyer of the Cyprus Community Club, or you may request a copy by contacting the Community by phone or by email at cyprusclub@optusnet.com.au, by 5 pm, October 20, 2023.

Any questions you may have can also be submitted by 5pm, October 20, 2023, in writing at the front office during business hours or by email to: cyprusclub@optusnet.com.au.

The Community is also holding information sessions at the Cyprus Club ahead of the EGM. They will be held on Sunday, 15 October (2-4pm), Wednesday, 18 October (6-8pm), and Sunday, 22 October (12.30-2.30pm – prior to EGM vote).