By Despina Karpathiou

Scams are everywhere these days, and nobody is immune.

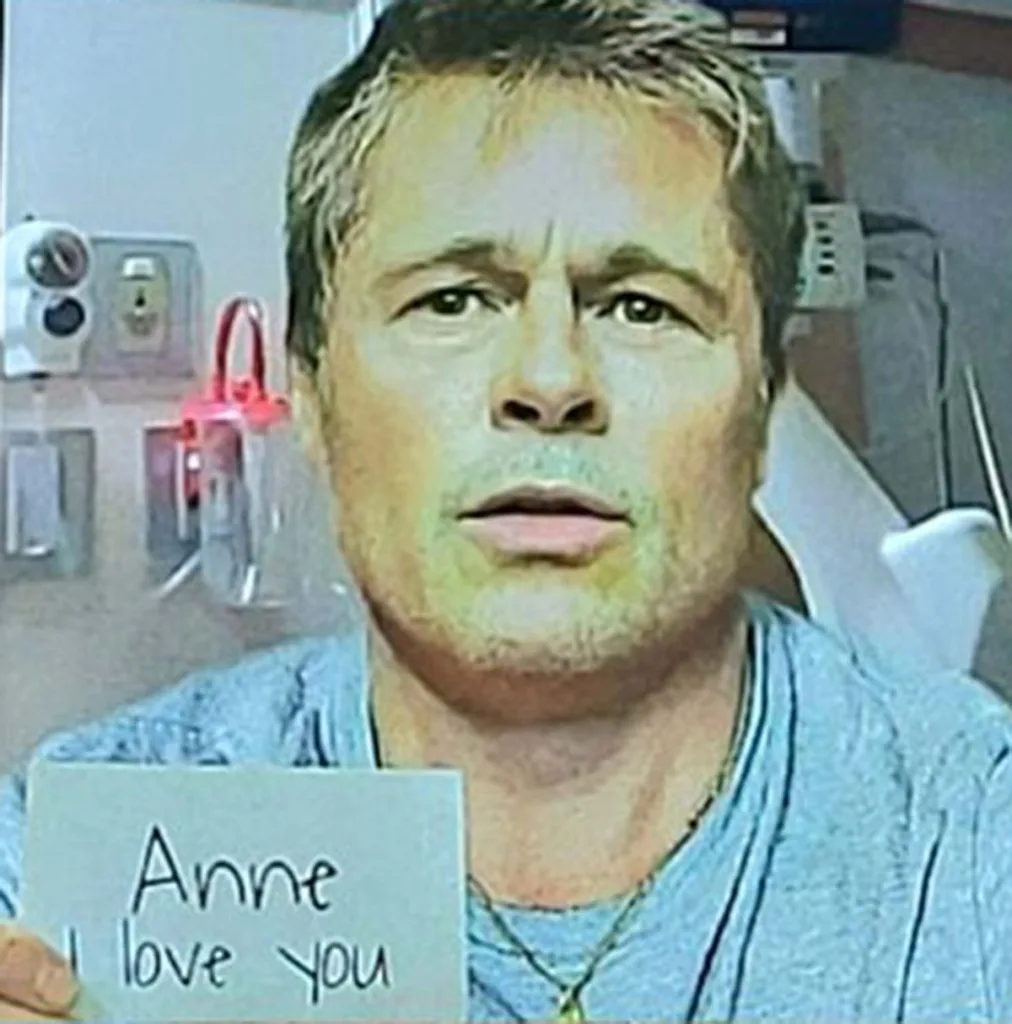

I’m sure everyone remembers the French woman who was scammed out of her life savings by individuals posing as Brad Pitt. The scammers used AI-generated images and fabricated stories, leading to a public outcry and the removal of a TV report about the incident due to a wave of online mockery.

As embarrassing as this was, we can all learn from the case. To help us understand more about scams, we spoke with Evangelos (Evan) Frangos.

Evan, a private detective from Adelaide, South Australia, is the owner of South Australian Private Detectives and Director of the Australian Anti-Scam Alliance (AASA), a national body aimed at reducing scams through education and scam awareness.

Hailing from Ikaria, Greece, Evan is also a Certified Cryptocurrency Investigator, specialising in recovering funds lost to scams and hacks.

The Greek Herald spoke to Evan about all things scams and how to avoid getting sucked into one.

He explains that the rise in scams and fraudulent activities can be attributed to several interconnected factors:

- Technological Advancements: The rapid growth of the internet and digital communication has made it easier for scammers to reach a larger audience.

- Increased Online Activity: As more people conduct their lives online—shopping, banking, and socializing—scammers have more opportunities to exploit vulnerabilities. The COVID-19 pandemic accelerated this trend, leading to a surge in online interactions.

- Psychological Manipulation: Scammers often use psychological tactics to exploit human emotions such as fear, urgency, or greed.

- Lack of Awareness: Many people are still unaware of the various types of scams and how to recognize them.

- Globalization: The internet allows scammers to operate across borders, making it difficult for law enforcement to track and prosecute them.

- Economic Factors: Economic instability and financial hardship can drive individuals to engage in scams, either as perpetrators or victims.

- Anonymity and Low Risk: The anonymity provided by the internet allows scammers to operate with a lower risk of being caught.

- Social Engineering: Scammers often use social engineering techniques to manipulate victims into providing personal information or money.

- Technological Countermeasures: As technology evolves, so do the methods used by scammers.

“Overall, the combination of these factors creates an environment where scams can thrive, making it essential for individuals to stay informed and vigilant against potential threats,” Evan explains.

So, now that we know why scams happen and how they happen, let’s learn how to best prevent them.

Evan says that reducing the risk of being scammed involves “a combination of awareness, education, and proactive measures.”

He outlines several strategies to help protect yourself and your family:

- Educate Yourself: Stay informed about common scams and tactics used by scammers. Familiarize yourself with the latest trends in fraud, such as phishing, identity theft, and investment scams. Join our Facebook group, Scams Australia, where members share scams, they have encountered.

- Verify Sources: Always verify the identity of individuals or organizations that contact you, especially if they request personal information or money. Use official websites or contact numbers to confirm legitimacy.

- Be Sceptical of Unsolicited Communications: Be cautious of unsolicited emails, phone calls, or messages, especially those that create a sense of urgency or fear. Scammers often use these tactics to pressure victims into acting quickly.

- Use Strong Passwords: Create strong, unique passwords for your online accounts and change them regularly. Consider using a password manager to keep track of them.

- Enable Two-Factor Authentication (2FA): Whenever possible, enable 2FA on your accounts. This adds an extra layer of security by requiring a second form of verification in addition to your password.

- Monitor Financial Accounts: Regularly check your bank and credit card statements for any unauthorized transactions. Report any suspicious activity immediately.

- Limit Personal Information Sharing: Be cautious about the personal information you share online, especially on social media. Scammers can use this information to tailor their attacks.

- Use Secure Connections: When entering sensitive information online, ensure that the website is secure (look for “https://” in the URL). Avoid using public Wi-Fi for financial transactions, especially at airports.

- Trust Your Instincts: If something feels off or too good to be true, trust your instincts. Take a step back and evaluate the situation before proceeding.

- Report Scams: If you encounter a scam, report it to the appropriate authorities or local law enforcement. If you have been scammed, write a report to Scamwatch through the ACCC or www.cyber.gov.au. This can help prevent others from falling victim.

- Educate Others: Share your knowledge about scams with friends and family. The more people are aware of potential threats, the less likely they are to fall victim.

- Use Security Software: Install and regularly update antivirus and anti-malware software on your devices to help protect against malicious attacks. Consider using a VPN (Virtual Private Network).

- Be Cautious with Investments: If you’re considering an investment opportunity, do thorough research and consult with a financial advisor. Be wary of high-pressure sales tactics and promises of guaranteed returns.

“By adopting these practices, you can significantly reduce your risk of being scammed and help protect yourself and others from fraud,” Evan concludes.

If you find yourself in a situation where you’ve been scammed, Evan explains that it’s crucial to take immediate action to minimise the damage and protect yourself from further harm.

Here are the most important steps you should take:

- Stay Calm: While it’s natural to feel upset or anxious, try to remain calm so you can think clearly and take appropriate action.

- Document Everything: Gather all relevant information about the scam, including emails, messages, transaction records, and any other evidence. This documentation will be helpful when reporting the scam.

- Report the Scam to Authorities: Report the scam to your local law enforcement agency and the Federal Police via the Report Cyber portal at www.cyber.gov.au, as well as to Scamwatch through the ACCC.

- Contact Financial Institutions: If you provided financial information or made a payment, contact your bank or credit card company immediately. They may be able to reverse the transaction or help you secure your accounts.

- Report to Online Platforms: If the scam occurred on a specific platform (such as social media or an online marketplace), report the scammer to that platform.

- Change All Passwords: If you shared any passwords or personal information, change your passwords immediately. Use strong, unique passwords for each account and consider enabling two-factor authentication.

- Consider a Credit Freeze or Fraud Alert: If you believe your personal information has been compromised, consider placing a fraud alert on your credit report or freezing your credit. This can help prevent identity theft.

- Seek Support: Talk to friends or family about the situation. They can provide emotional support and may offer additional advice. If you feel overwhelmed, consider speaking with a professional counsellor.

- Stay Vigilant: Be cautious of follow-up scams. Scammers may try to contact you again, posing as someone who can help you recover your losses.

- Consider Legal Advice: If the scam resulted in significant financial loss or if you are facing legal issues, it may be wise to consult a legal professional.

In conclusion, it’s always better to prevent scams than to deal with their consequences, which is why education is key.